Medigap Plan G – An Alternative To Medicare Supplement Plan F

As you get older, your priority should be your bucket list, not your medical bills. But what are the most comprehensive healthcare options available? Currently, Medicare supplement Plans F and G are looked at as the best ways to take the surprises out of medical costs. While you may have heard about the merits of Medicare supplemental Plan F as a necessary addition to standard Medicare, important shifts are taking place that are calling you to seek out another option—and that alternative exists in the form of a Plan G Medicare supplemental policy.

As a result of the Medicare Access and CHIP Re-authorization Act of 2015, Medicare Plan F will be phased out before January 1st, 2020. While coverage under Plan F will continue for those already signed up, new enrollees will no longer be accepted. The repercussions of this are twofold:

- If you already have Plan F, an aging clientele will mean your premiums will only increase down the road.

- If you don’t, the option to enroll in Plan F will simply not be available to you in the future.

Luckily, this is no reason for concern. Plan G can easily fill the void at lower rates than what you might have expected to pay.

If you’re feeling overwhelmed, don’t worry. We’ll explain step-by-step why it’s important for you to enroll in a comprehensive supplement plan, as well as what the difference is between the available medicare options.

Do I need a Medicare Supplement Plan?

If you are over or approaching 65, then the answer is yes.

The last thing you want to deal with when you are ill or injured is the stress of having to fork out money you have not budgeted for. Unforeseen medical bills only serve to compound the stress of being ill. To ensure you do not have to suffer being hit with unexpected costs, you need to have a plan in place.

There are two options here:

- Medicare Advantage (or Part C)

- Original Medicare, plus a Part D prescription drug plan and a Medicare supplemental plan, also known as Medigap.

Medicare Advantage is private insurance. While many of these plans look as though they will save you money upfront, they can end up costing you far more in the future—both in terms of money and convenience. Hidden costs and limited networks of healthcare providers, to name but two issues, can lead to later financial regret.

The other option is to combine your original Medicare with a Medigap plan. If comprehensive coverage is what you are after, your options are Medigap Plans F and G. Both plans cover supplement benefits, inpatient and outpatient services, and foreign travel.

Diving into Medicare Supplements Plan F and G

So what is the difference between the two, and how should you choose the best plan to suit your needs?

Standardized insurance plans through private companies

The first thing to understand about both Medigap Plans F and G is that they are standardized. While the plans are offered at different costs through private companies, the benefits you receive are regulated. The primary piece of advice we can offer here is not to pay more for an identical policy that you can get at a lower cost.

The differences between Medicare Plan F and G

The next step is choosing between the two plans. If you have already made this choice, it might be worth revisiting your decision. As we have already mentioned, Plan F is in the process of being phased out. Insurance rates decrease based on popularity, so it is not difficult to see that for this reason alone, it is advisable to move over to a more sustainable plan.

But what are the differences between the services the two plans offer? Will you still be receiving the same coverage if you move over? Are there any hidden costs attached to Plan G?

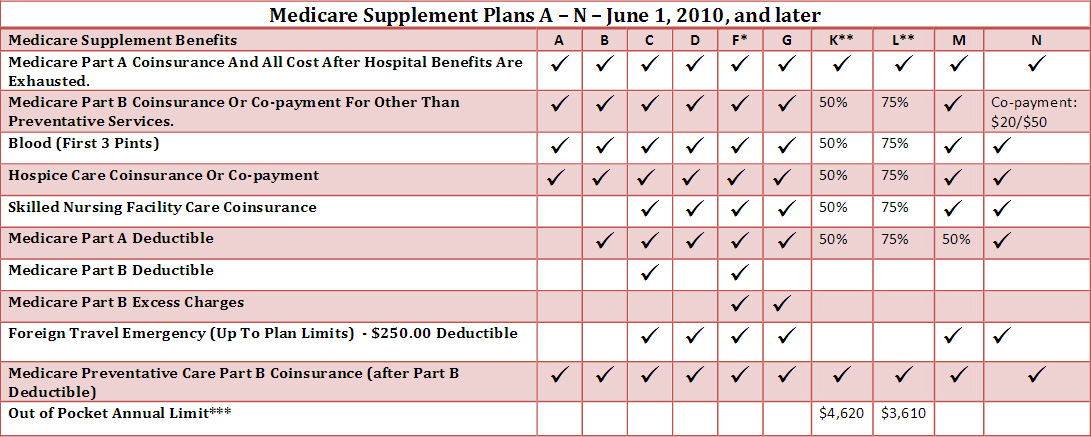

To answer these questions, let’s have a look at this table the Florida Office of Insurance Regulation issued of the various supplement plans available:

Source: https://www.floir.com/siteDocuments/MedSupPlanCharts.pdf

According to the chart, the difference between the two is that Plan G does not include the $185 Medicare Part B deductible, while Plan F does. If you have not heard of Part B before, it covers outpatient care that is deemed to be necessary. This can include doctor’s visits, diagnostic imagery, dialysis, ambulance rides, and treatments such as chemotherapy, to name a few.

The next question is whether not having the deductible covered is a smart financial move or not.

The financial case for choosing Medigap Plan G

Is not having to pay the extra Part B deductible a good enough incentive to stick with Plan F? The answer is no, it’s not. If you crunch the numbers, you will be able to see how quickly the extra cost is absorbed into the overall financial benefits of Plan G.

Here are five simple reasons to choose Plan G:

1. The Medicare Plan F cost is substantially higher.

While Medicare Part F rates include the Part B deductible, this annual fee by no means offsets the difference in price between the two plans. Shop around on our website for the cost of Plan G in your area and you will quickly see that it makes financial sense to pay the additional annual fee of $183 in addition to your supplementary insurance. The cost difference between Plan F and G options can be over $400. Spend $185 to keep $400? Makes sense to us.

2. The Medicare Supplement Plan G cost has a lower rate increase as it gains in popularity.

While Plan F has been the popular option for the last few years, this is set to change. As we look to the 2020 changeover, the popularity of Plan G is gaining traction. The result is lower future premiums for you if you choose to make the switch.

3. You will receive comprehensive hospital care.

Going to the hospital can be crippling in more ways than one. When you are fit and healthy, it is often hard to imagine lying in a hospital bed. Like it or not, unfortunately we all have to budget for this potential setback. With all you would have to deal with in this event, make sure your purse doesn’t suffer as well.

By choosing Plan G over Plan F, you are not forgoing any of your coverage. Plan G will fully insure you against any medical eventuality. If you’re wondering about how it will work together with Medicare, your standard policy will pay 80% of your bills, and Plan G will cover the remainder.

4. You no longer have to worry about foreign travel cover.

If you are using your twilight years to see the world, Plan G will ensure you do not have to worry while you do so. With up to $50,000 in foreign travel emergency benefits, you can focus on all those new sights and smells while Plan G serves as your invisible Armour.

5. Be ahead of the curve when it comes to industry changes

The reality is that the change is coming, and very soon. Why deliberate? You don’t want to be sitting five years down the line wishing you had made the decision earlier.

How do I get Plan G?

Are you as convinced as we are that this is the best move for your future health? We thought so.

The great news is, regardless of whether you already have a supplementary policy or not, getting on board with Plan G is simple and easy. Costs vary depending on factors such as your age, lifestyle and area you live in, so head over to the SecureCare65 website to get a quote that will take all the guesswork out of the decision.

To make sure you make an informed decision that will benefit you in the long term, we have included a comparison tool that will allow you to have a look at the various options.

Your golden years should be polished with tears of joy, not anguish. To make sure this happens, it is vital that you put the time in to research the health insurance options available so you can make a decision that benefits you in the long run.

If you would like to talk to an advisor about your options, feel free to give us a call at 1-800-354-1078. It might just be the call that changes the way you feel about healthcare.